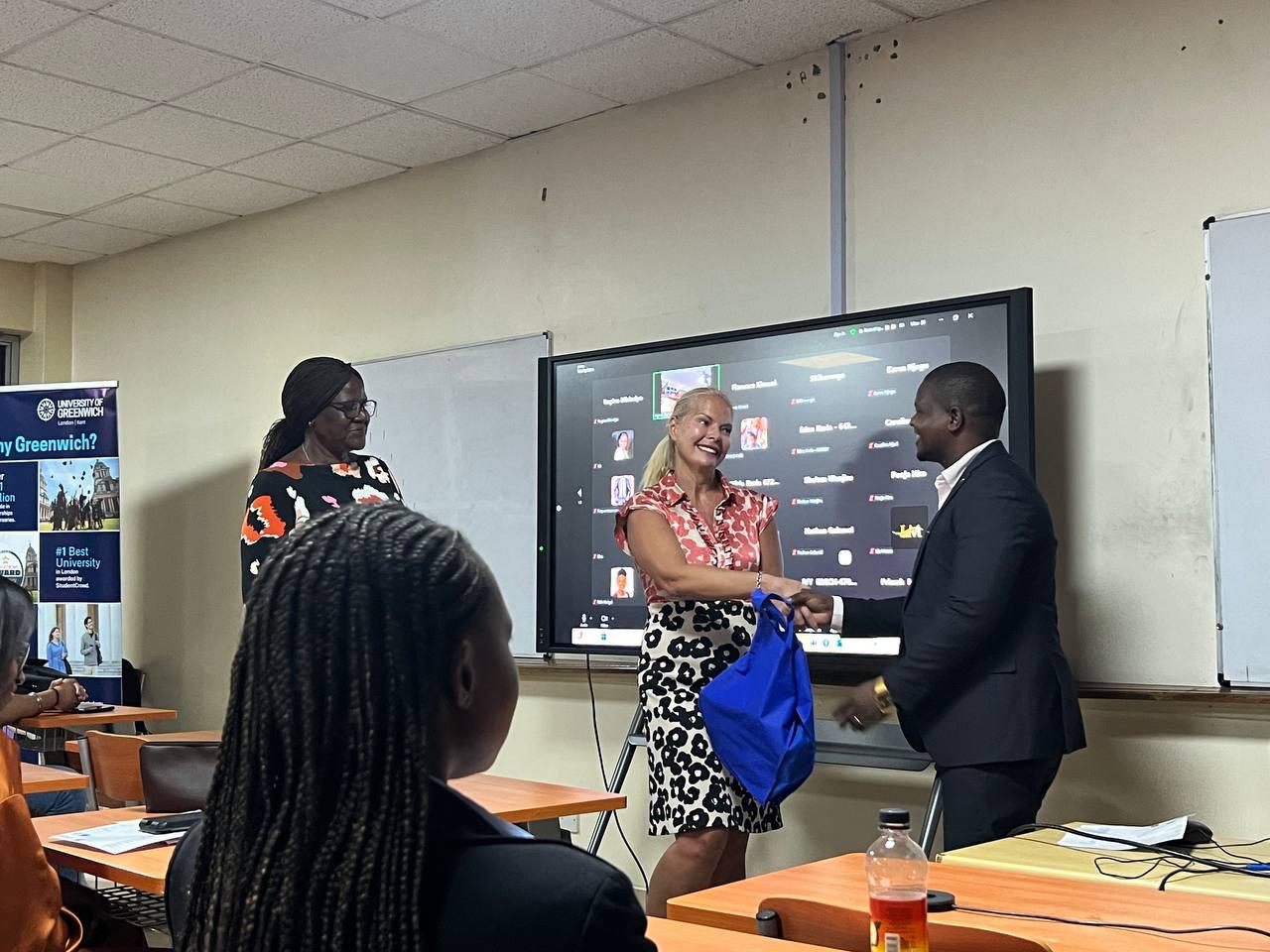

Earlier this year, Dr Ana Armstrong, Senior Lecturer in Finance here at Greenwich Business School, travelled to Kenya to speak at the University of Nairobi and the United States International University (USIU). Her guest lecture was a timely conversation about how fintech is opening up access to finance in regions where traditional systems have often fallen short.

Fintech is one of the fastest-growing job markets of the next decade. As finance and technology continue to merge, this evolving sector is reshaping everything from how we bank to how we invest and manage value. And at the centre of this shift is education — helping people understand the systems behind the buzzwords and preparing them to shape the future of finance.

“Fintech gives us a way to rethink who has access to money and how it moves,” Ana explained. “It’s not just about new technology — it’s about creating opportunities that weren’t there before”.

In both universities, Ana unpacked the origins of Bitcoin — a direct response to the 2008 financial crisis. Created by the anonymous figure Satoshi Nakamoto, Bitcoin aimed to solve the double-spending problem and eliminate the need for traditional intermediaries like banks or governments. It was a radical idea: a peer-to-peer electronic cash system based not on trust, but on cryptographic proof.

This concept of decentralisation soon evolved into a wider ecosystem. Ethereum followed, enabling programmable transactions through smart contracts — computer code that automatically executes terms of an agreement. From there, the fintech space exploded into digital tokens, non-fungible assets (NFTs), decentralised exchanges, and increasingly complex protocols that challenge the very idea of what money and ownership mean.

“These aren’t just tools for investment,” Ana explained. “They’re being used to manage land rights, improve transparency in supply chains, and offer financial services in areas that have long been underserved”.

She also shared insights from our MSc Fintech and Finance, a programme built to prepare students for the rapidly changing world of finance. The course covers the critical elements of finance and technology, and how these two forces are shaping the future of finance.

“What I found in Kenya was genuine curiosity,” Ana said. “People were asking the same questions our students ask — how does it work, what are the risks, and how can we make it better?"

With London leading the way as a global fintech hub, the MSc at Greenwich is positioned to prepare students for roles across digital finance, asset management, blockchain development, and beyond. And with mentoring from industry professionals and access to the university’s Generator entrepreneurial hub, students are supported every step of the way.

Fintech is no longer a fringe topic. It’s mainstream, and it’s changing how the world interacts with value. From Kenya to the UK and beyond, the future of finance is being shaped now — and those who understand it will be leading the change.

Discover more about our accounting and finance degrees and how to apply.

IMPORTANT NOTE: Please note that the availability of modules (and opportunities offered to, and services for, students) can change over time and things may not be available from one year to the next. In the case of modules, please always check the 'What will you study' section of the course webpage for the course and entry year you are interested in. You can find an index of all our subject areas, within which you will find the individual course pages, at: https://www.gre.ac.uk/subjects