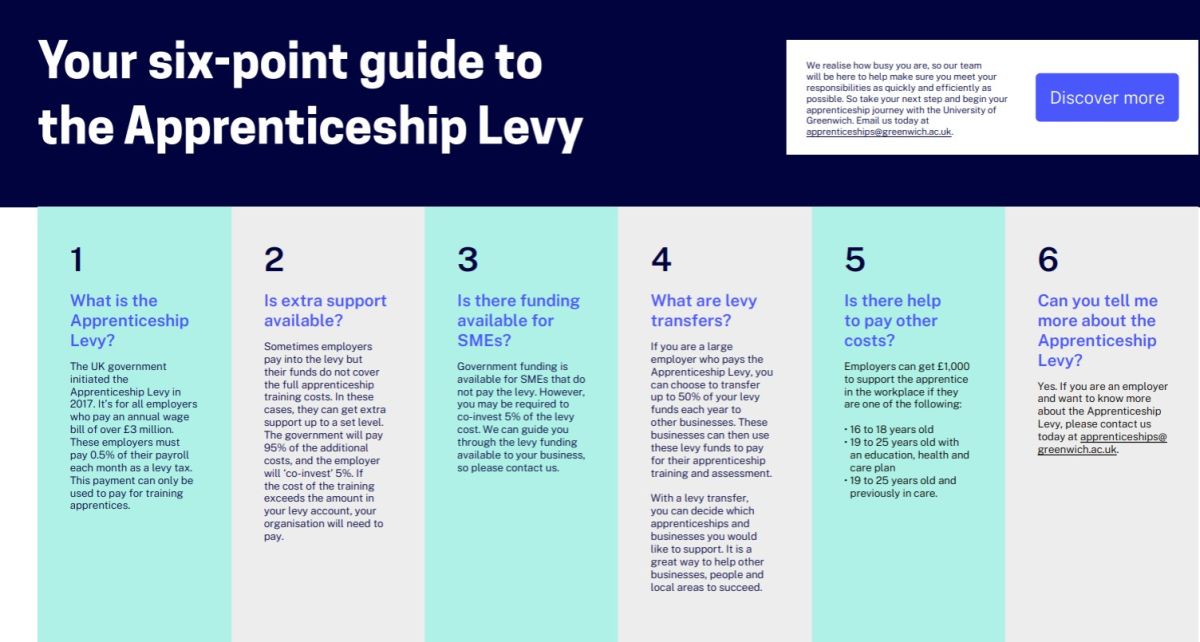

1. What is the Apprenticeship Levy?

The UK government initiated the Apprenticeship Levy in 2017. It’s for all employers who pay an annual wage bill of over £3 million. These employers must pay 0.5% of their payroll each month as a levy tax. This payment can only be used to pay for training apprentices.

2. Is extra support available?

Sometimes employers pay into the levy but their funds do not cover the full apprenticeship training costs. In these cases, they can get extra support up to a set level.

The government will pay 95% of the additional costs, and the employer will ‘co-invest’ 5%. If the cost of the training exceeds the amount in your levy account, your organisation will need to pay.

3. Is there funding available for SMEs?

Government funding is available for SMEs that do not pay the levy. However, you may be required to co-invest 5% of the levy cost. We can guide you through the levy funding available to your business, so please contact us.

4. What are levy transfers?

If you are a large employer who pays the Apprenticeship Levy, you can choose to transfer up to 50% of your levy funds each year to other businesses. These businesses can then use these levy funds to pay for their apprenticeship training and assessment.

With a levy transfer, you can decide which apprenticeships and businesses you would like to support. It is a great way to help other businesses, people and local areas to succeed.

5. Is there help to pay other costs?

Employers can get £1,000 to support the apprentice in the workplace if they are one of the following:

- 16 to 18 years old

- 19 to 25 years old with an education, health and care plan

- 19 to 25 years old and previously in care.

6. Can you tell me more about the Apprenticeship Levy?

Yes. If you are an employer and want to know more about the Apprenticeship Levy, please contact us today at apprenticeships@greenwich.ac.uk.